Healthcare systems across the globe are facing rising costs of operation, a shortage of skilled labour, and budgetary restraints, resulting in a reduction of efficiency and quality of care. An aging population, and increasing need for chronic disease management, and healthcare access provision for the geographically fragmented population, requires the use of IT to alleviate the pressures on healthcare systems.

With the global market penetration of mobile phones reaching 96%, and about 40% of the world’s population having access to the internet, machine-to-machine (M2M) communications for healthcare and mobile health (mHealth) have the potential to revolutionise the physician-to-patient interaction in healthcare environments. The emergence of cloud technology in patient data gathering, storage and sharing has made healthcare decision-making easier, as physicians have access to relevant information.

The advent of a patient-centric model of care delivery and an increase in the use of patient data collected from a multitude of healthcare information solutions for clinical decision-making, alongside the aforementioned developments in mobile devices, the internet and the cloud – as well as the interoperability of the various healthcare solutions – have fuelled the growth of M2M and mHealth solutions.

However, ambiguity regarding the regulatory guidelines for interoperability and patient data-sharing standards are in a nascent stage, and that has restricted the potential of M2M and mobile applications for healthcare. Data security and privacy concerns are also a major factor restraining the growth of this high-potential segment.

The majority of the M2M and mHealth solutions developed by healthcare IT solution providers, telecoms service providers and mobile network operators are targeted at healthcare professionals and consumers.

Solutions for healthcare professionals include clinical decision support systems, remote monitoring solutions, drug reference and literature searches, medical training and patient data storage sharing, especially imaging data.

For healthcare consumers, most of the products are offered in the area of fitness and well-being, nutrition and diet, chronic disease management, medication alerts and self-management of medical records.

Healthcare providers all over the world have recognised the potential of electronic devices in the delivery of superior care and are investing in development of infrastructure in order to maximise its efficacy.

Adoption of electronic medical records (EMR), hospital information systems (HIS), patient administration systems (PAS), e-prescribing, medication management and computerised physician order entry systems (CPOE) by hospitals is increasing by the day.

Right person, time and location

While the primary interest of hospitals is to focus on investments in the above solutions, a few hospitals have moved to the second phase: investing in healthcare IT solutions for telehealth, remote patient monitoring, assisted living and clinical content management.

#By introducing healthcare IT, the objective of these hospitals is to optimise resource use, thereby reducing avoidable readmissions, emergency room visits and average length of stay in a bid to reduce the total cost of operations.

Healthcare providers are moving in the direction of fully connected hospitals that use highly connected communication networks for integrating multiple IT solutions so that the right information is available to the right person at the right time in the right location. This is particularly relevant because there is a dire need for integrating patient data from disparate sources to derive meaningful insights that support clinical decision-making in a healthcare environment.

Previously, the focus was limited to data-gathering and archiving, which has resulted in redundant data being stored in independent silos in the hospital network. With a connected hospital framework, healthcare providers aim to create a new healthcare delivery model that synergises payers, providers, patients and regulatory bodies to drive efficiency and quality of care.

Age of the super-hospital

Alcatel-Lucent, Orange Healthcare and Stryker are major market participants in the connected hospital solutions space that have benefitted from high interest among healthcare providers to upgrade their existing healthcare IT infrastructure in order to increase patient safety and engagement through technology-intensive solutions. Furthermore, availability of supporting technology, such as high-speed broadband and wireless networks, has encouraged adoption of connectivity solutions.

However, the barriers to rapid adoption of connected hospitals are issues of interoperability among the various systems, absence of reimbursement policies and data security concerns. Several solution providers are working on overcoming these hurdles.

Several governments are investing in this market space. Denmark, for example, has invested €6.7 billion in the development of eight superhospitals in the country, with the objective of offering centralised care from optimised public spending.

Another example is the proposed New North Zealand Hospital – for which construction will begin in 2017 at an estimated cost of €510 million – aimed at providing healthcare services for 312,000 citizens in the area of acute care, elective care and outpatient treatment.

These investments provide immense opportunities for healthcare IT vendors, telecommunication service providers and mobile network operators to provide solutions in areas such as hospital logistics, automation systems and IT systems. The successful completion of superhospital construction and operation requires close collaboration among the relevant stakeholders from healthcare IT, provider and regulatory authorities.

Grab your partner

At this juncture, M2M communication and mHealth application providers have a significant role to play in creating a ubiquitous health (uHealth) environment, especially in supporting virtual hospitals empowered by remote project management, robotics, teleconsultation and telesurgery.

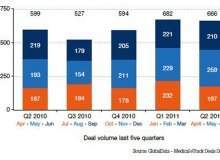

Several partnerships have been formed between medical device manufacturers, pharmaceutical companies, telecommunication providers and mHealth application development companies to tap into the potential of this high-growth market. For instance, in March 2014, Vodafone entered a global partnership with Astra Zeneca to provide mHealth services for cardiovascular patients. With this collaboration the companies plan to offer new mobile and internet-based services for long-term condition management, with Vodafone providing the technology, infrastructure and expertise for Astra Zeneca’s cardiovascular therapy.

Similarly, in January 2014, WellDoc, the mHealth application provider of BlueStar, which is the only FDA-approved mobile application for diabetes management, generated $20 million from the Merck Global Health Innovation Fund and Windham Venture Partner.

What these partnerships do is demonstrate the interest of big pharmaceutical companies in collaborating with digital health businesses, especially in the area of big data, including informatics and integration, personalised medicine and technology-enabled care.

Smarten up

mHealth solutions are transitioning from applications that can be downloaded and subscribed to for use in smart devices to more integrated, clinical, personalised and collaborative mHealth solutions.

These mobile applications of the future will have much-advanced features, such as data visualisation, and speech or sensor enablement, and will be part of a larger ecosystem of healthcare systems comprising of EHR, HIS and medical devices.

With respect to end users, the boundaries between mobile applications for healthcare professionals and consumers are gradually overlapping, especially with the rise of collaborative care and the convergence of mobile wireless technologies.

Currently, most of these mobile applications are developed by healthcare IT providers, healthcare professionals, medical solution providers and healthcare institutions.

In the future, more involvement in mobile application and mHealth solution development is expected from consumer goods companies, pharmaceutical companies and mobile network providers. For instance, Deutsche Telekom and Orange have teamed up with AT&T in the US for a ‘smart home’ platform that allows easy and secure integration of home healthcare apps. A revitalisation of the distribution channels is also expected in future, wherein mobile applications currently available in major mobile platforms will also be available in web portals of pharmacies and medical device companies.

Most of the mobile applications currently being developed are input-output platform-agnostic, meaning they can work across iOS, Android, Windows and Blackberry operating systems.

Furthermore, applications are also being written in languages other than English, such as French, German, Italian and Spanish. Currently, the US has a high adoption rate for mHealth, while Europe and Asia-Pacific have moderate rates of adoption. However, in the coming three to five years, there will be high adoption of mHealth applications across the globe.

Delivering value

With innovations that revolutionise the way they are delivered and the power to influence the interaction between physician and patients, M2M and mHealth look to be the biggest concepts in healthcare – they have the means to deliver value to millions of patients across the globe.

To conclude, mHealth shows enormous promise as a healthcare delivery model that will have a phenomenal impact on patient-centric care and patient engagement.