Through the acquisition, Smith+Nephew will obtain CartiHeal’s cell-free, off-the-shelf implant Agili-C, which promotes the natural regeneration of the articular cartilage and was CE-marked for use in cartilage and osteochondral defects in traumatic and osteoarthritic joints

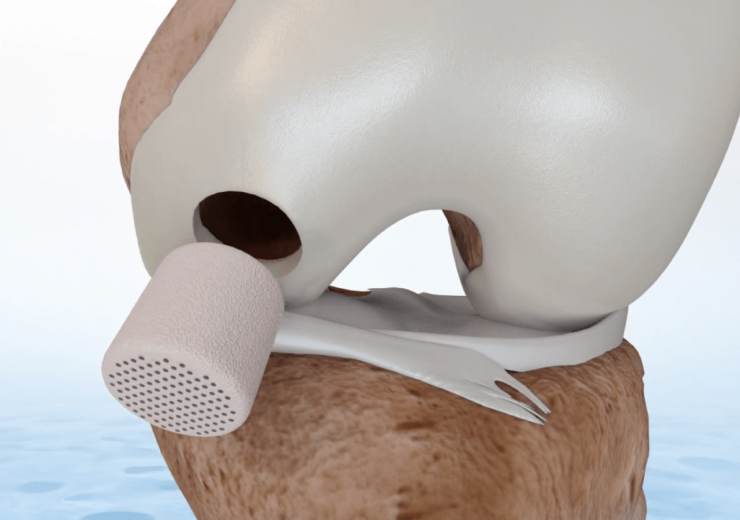

Agili-C is a porous, biocompatible, and resorbable scaffold. (Credit: Smith+Nephew)

British medical technology company Smith+Nephew has agreed to acquire Israeli medical equipment manufacturer CartiHeal for an initial consideration of $180m plus contingent payments of up to $150m.

Established in 2009 as a university spin-out, CartiHeal develops unique implants for the treatment of cartilage and osteochondral defects in traumatic and osteoarthritic joints.

The company operates a small facility located near Tel Aviv and a sales office in New Jersey, US, with large volumes of raw materials stocked in the US.

Upon closing of the transaction, which is expected in the first quarter of 2024, all the CartiHeal employees are anticipated to move to Smith+Nephew.

Also, CartiHeal will have adequate raw materials in the US to support its commercial launch.

The British medical equipment manufacturer intends to finance the acquisition using available cash on hand and debt facilities.

Smith+Nephew CEO Deepak Nath said: “The acquisition of this disruptive technology supports our strategy to invest behind our successful Sports Medicine business.

“Agili-C’s superior clinical performance makes it highly complementary to our existing knee repair portfolio and with our proven commercial expertise in high-growth biologics, we are confident that we will drive further success with this compelling treatment option.”

Through the acquisition, Smith+Nephew will obtain Agili-C, a cell-free, off-the-shelf implant CE-marked for use in cartilage and osteochondral defects in traumatic and osteoarthritic joints.

Agili-C is a porous, biocompatible, and resorbable scaffold, designed to promote the natural regeneration of the articular cartilage and restoration of its underlying subchondral bone.

In 2020, Agili-C was granted the US Food and Drug Administration (FDA) Breakthrough Device designation status and Premarket Approval (PMA) in March last year.

The US regulator granted PMA based on the results of a two-year randomised controlled trial, which validated the superiority of Agili-C over the current standard of care in patients with mild and moderate osteoarthritis.

CartiHeal founder and CEO Nir Altschuler said: “As a leader in sports medicine and with a deep knowledge of biologics, Smith+Nephew is the ideal new home for Agili-C.

Smith+Nephew sports medicine president Scott Schaffner said: “We have shown with REGENETEN that we have the market development and commercialisation expertise to take novel technologies and successfully establish a new standard of care.

“Agili-C is the perfect addition to our portfolio and we look forward to leveraging our expertise to transform cartilage repair outcomes for patients.”

In April last year, US-based orthopaedic therapies and diagnostic tools developer Bioventus exercised its option to purchase the remaining stake in CartiHeal for an upfront payment of up to $315m plus additional contingent payments of up to $135m.