The challenge of finding reliable and high-quality suppliers has the potential to be a headache for all medical manufacturers. Identifying companies that can guarantee standards that meet their requirements is an essential element of any OEM’s procurement strategy. Failing to do this effectively can land a company in trouble with regulatory bodies, which insist on seeing evidence in a contract to support proper quality control.

How can identifying the best partners to work with be achieved in the most effective and efficient way? That’s where MedAccred comes in.

An accreditation programme with audits built in by experts, it gives suppliers and manufacturers a ‘gold standard’ seal to show they meet a high level of performance in the medical device marketplace.

Run by a non-profit called Performance Review Institute (PRI) in the US, MedAccred launched in 2013 after the idea was floated at a roundtable meeting of medical device industry leaders held the previous year. Originally inspired by a similar scheme in the aerospace sector, it has since grown into an internationally recognised assessment process that many of the largest medical manufacturing companies look to for suppliers with a proven track record of quality.

The programme “provides consistent and standardised critical process accreditation accepted by the medical device industry resulting in fewer redundant on-site audits by multiple OEMs”, according to the PRI’s mission statement, as well as providing “greater visibility of the supply chain to all levels and sub-tiers that provide critical processes, consistent with regulatory requirements”.

The PRI also says MedAccred can help achieve greater efficiencies, continuous improvement and better outcomes. For Dannette Crooms, vice-president of supplier quality at Edwards Lifesciences, these lofty ambitions have been met and have made the programme an essential element of the company’s supply and procurement strategy.

“MedAccred provides us really good control and understanding of our supply base,” she says.

“When a supplier has been through the MedAccred process, we know they have a higher level of patient safety and control over their processes.”

Crooms says Edwards will look to its list of MedAccred suppliers first before widening the search if necessary. “It’s a first-stop shop,” she says.

The audit process

Audits are conducted by experienced and trained experts in their fields on behalf of subscribing members – all of which are medical device OEMs.

Audits can be carried out across a number of specialities – harnesses, heat treating, plastics, circuit boards, sterile packaging, sterilisation and welding – as well as across borders, with accreditations granted to several companies outside of the US, including the UK, France, China, Romania, Austria, Mexico, Costa Rica and Malaysia.

The process shows similarities to the Medical Device Single Audit Program (MDSAP) – a scheme set up by the FDA to harmonise auditing between the US, Canada, Japan, Brazil and Australia.

The major difference – apart from MedAccred being a global endeavour – is that MDSAP was created to ensure that suppliers met requirements outlined in several regulations, whereas MedAccred accreditation applies specifically to critical processes. Because this framework is agreed upon by MedAccred’s members, this often means suppliers have to reach a higher bar than simply satisfying regulatory rules.

Once a supplier has the MedAccred badge of approval, it gives a company like Edwards reassurance and confidence in the quality of the product they will receive.

As well as having to seek MedAccred approval for each process and location involved in the production of their goods, approved companies are reaudited annually, or once every 18 months following three successful audit cycles.

“I like to use the phrase ‘stable and capable’ for suppliers with MedAccred [accreditation],” says Crooms, who has worked for Edwards for nearly 15 years.

“It is very important to the market and is growing in importance with more and more influence,” she says.

MedAccred initially launched with just Johnson & Johnson, Phillips and Stryker, but has grown to ten members, including other industry heavyweights like Medtronic, Roche and Becton Dickinson.

Commercial and cost benefits

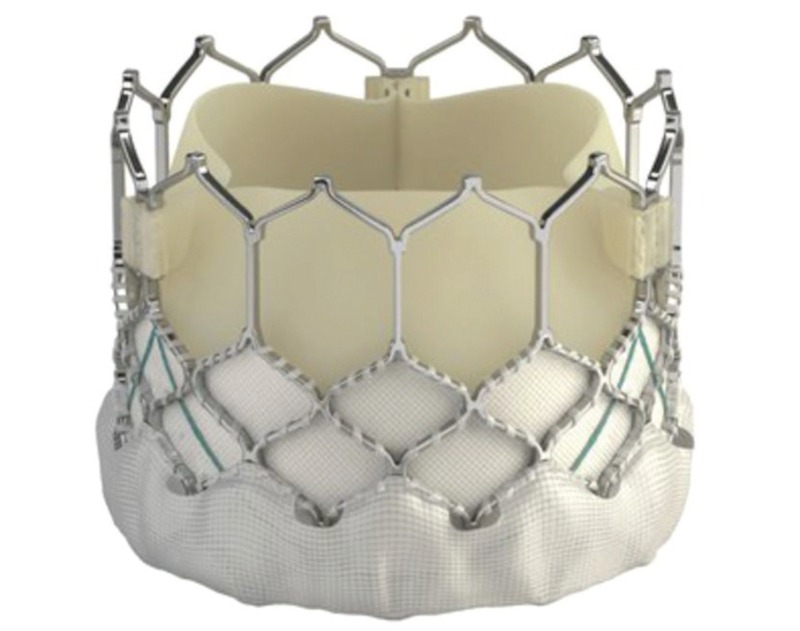

In the area of sterile manufacturing, MedAccred is particularly influential, says Crooms, and this is critical to Edwards, which specialises in heart valves and haemodynamic monitoring – both of which require thorough sterilisation to decrease patient infection risk. Previously, the company would have carried out its own audits of each supplier at an incremental cost to the business. This is no longer the case with MedAccred’s ‘one-time audit hit’, which gives all companies under the MedAccred umbrella the quality and patient safety assurances they need.

Crooms says Edwards would still carry out an audit when a new supplier is chosen, but that may be a virtual audit to simplify the “onboarding” process. This approach means less cost and an eased audit burden for all partners in the supply chain.

Didier Hayem, supplier quality chapter lead for diagnostics operations quality at Roche, another MedAccred subscriber, says the programme ensures “a robust manufacturing process for key processes at the supplier,” and that the scheme “supports manufacturers in choosing the best partners.”

“The more suppliers that join, the more the benefi ts [will grow]. All the right principles are in place, and it will drive increased standards for product quality through the supply chain. It all comes down to patient safety.”

Dannette Crooms

The commercial benefits of MedAccred don’t end with its member companies however, with suppliers that demonstrate a strong commitment to quality and safety able to build demand for their products from programme subscribers.

“MedAccred provides a differentiation based on process control and capabilities. By showing that they are experts in their field and having the corresponding accreditation, contract manufacturers can have an edge over their competitors in the attribution process,” Hayem adds.

Many accredited suppliers attest to this fact on their own websites. Bob Reeves, operations director for US injection moulding specialist Kaysun, speaks of MedAccred placing the company “in an elite group of custom injection moulders” on Kaysun’s blog. Other organisations in the US recognise the survival imperative behind MedAccred. On its own website, Michigan Manufacturing Technology Center writes: “With OEMs preferring or requiring a supplier to hold MedAccred accreditation for new business, it is imperative that US manufacturers with critical processes gain accreditation, or risk being shut out by global competitors.”

That narrative seems especially poignant given that MedAccred won’t be going anywhere fast. Crooms describes the programme as having past its infancy stage and grown into “a teenager”. “There is lots of upside to go. We can see where the benefits are, with increased oversight of the supply chain and improved quality,” she adds.

Further development

Edwards plays an active role in the development of MedAccred, with Crooms leading a recent working group on contract manufacturers. The group spent a year looking at the role of contract manufacturing and producing a programme within MedAccred devoted to it. The new programme covers contractors and sub-contract partners and was developed with help from Bausch Health, Baxter, BD, Boston Scientific, Johnson & Johnson, Medtronic, Philips Healthcare, Roche Diagnostics and Stryker. Feedback from contract companies was a key part of the process as well.

There are also MedAccred working groups examining each of the MedAccred specialities, such as injection moulding and packaging suppliers.

A working group on labelling, printing and Unique Device Identifier, also led by Edwards, was set up in May. Expensive product recalls are one aspect being looked at by the group.

“The working groups determine the audit criteria, select auditors and approve audit reports. As we learn more, we update the criteria and the broader membership always gets to approve it,” Crooms explains. The future is bright for MedAccred, she says: “The more suppliers that join, the more the benefits [will grow]. All the right principles are in place, and it will drive increased standards for product quality through the supply chain. It all comes down to patient safety.”

Without MedAccred approval it may be increasingly difficult to operate in a market that sees it as so important. The ‘teenager’ is growing up, and when it is even more established it will be a must for supplier firms, if it isn’t already.

With patient safety, quality and commercial edge among MedAccred’s list of features, it’s a winning recipe that surely makes good sense for an industry always striving to be more efficient.