Refurbished medical equipment is by no means a brand new sub-sector within the broader healthcare industry — but new technologies, regulations and, of course, more recently, the omnipresent Covid-19 crisis, mean it is constantly evolving. Jamie Bell speaks to industry boss John Vano about one very specific component in this ecosystem — linear accelerators.

For cancer patients, visiting the nearest hospital or specialist clinic to get regular treatments can be stressful, daunting and burdensome enough in itself.

But, in many cases, this situation is made more testing by the lack of a local radiology oncology centre.

Those wanting to set up a radiotherapy clinic, particularly in remote or poorer areas, can rarely afford to meet the multi-million dollar price tag associated with a brand new linear accelerator, or LINAC — the machine used to provide radiotherapy treatment.

Because of this, patients in rural areas — or in developing countries where specialised, advanced medical facilities are often more sparse in general — may have to undertake a lengthy journey for appointments.

In some cases, they may even be unable to access this vital cancer treatment at all.

However, companies such as Radiology Oncology Systems (ROS) can provide a solution by refurbishing used LINAC machines and selling them to smaller healthcare providers for a fraction of their original cost.

The San Diego-based firm recently announced it is teaming up with Dignatel — a tech company that also works alongside manufacturers to provide the software featured in brand new machines — leaving ROS’ president John Vano “really excited” about the new partnership.

“One of the big changes we’re seeing now is that software is becoming an increasingly important part of the whole system,” he adds.

“It’s not just about whether or not you can provide a linear accelerator — it’s about the brains inside it, the software that’s on it, and what it can do.

“Used medical equipment is a very important sector in terms of filling a lot of the holes that exist in healthcare infrastructures.

“There are a number of industries that have these secondary markets — including cars, trucks, aeroplanes, helicopters, factory equipment, and farming equipment.

“Any time that there’s equipment with a useful life left in it, it makes sense to keep using it while it’s functional.”

The LINAC market

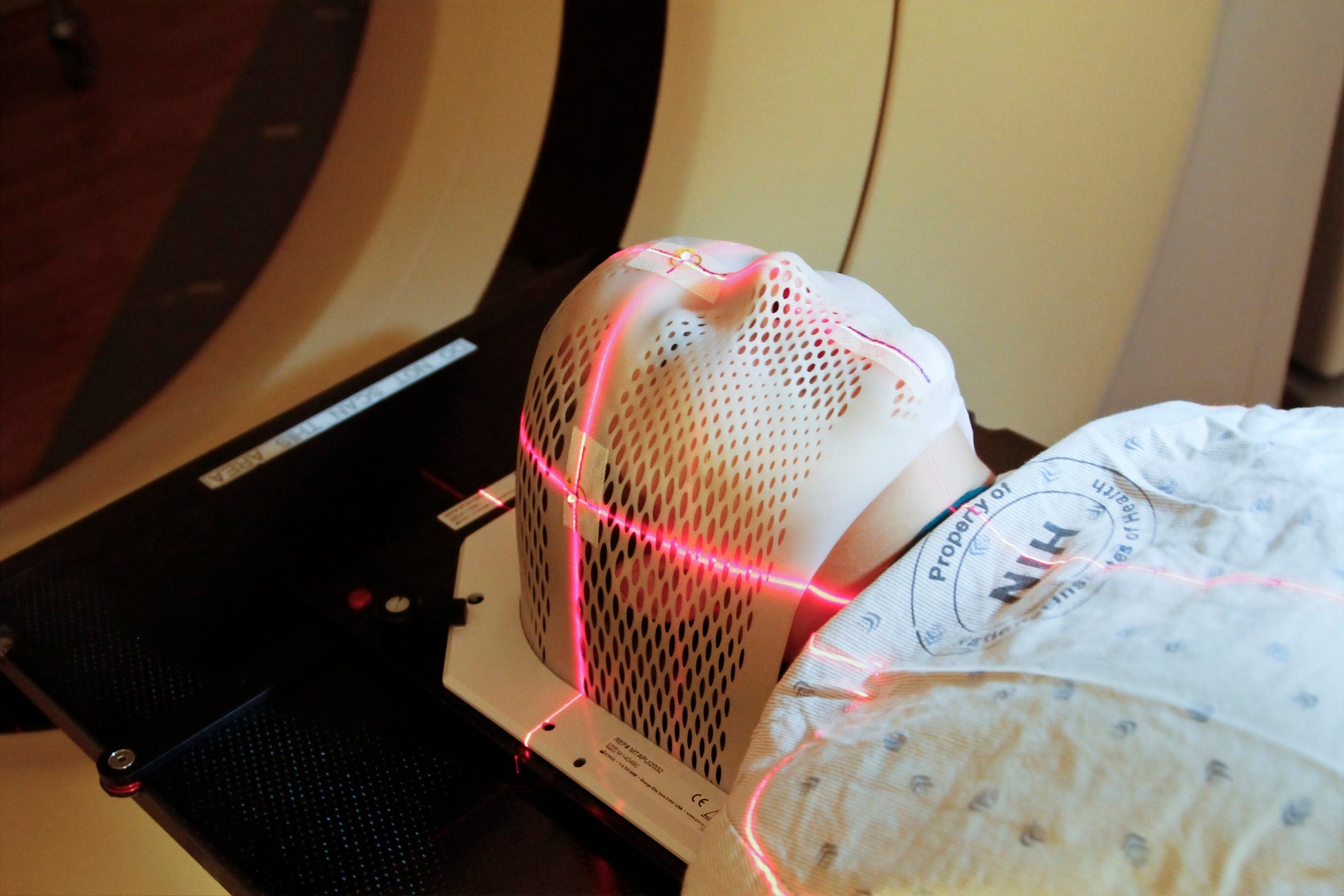

Linear accelerators produce high-energy X-rays, and deliver them precisely towards a patient’s tumour from multiple angles to ensure that cancerous cells are destroyed, and normal tissue in the surrounding area is undamaged.

At the start of the 21st century — around the time ROS was founded, in 1997 — there were three major players making these LINAC machines.

German tech giant Siemens, US-based radiation oncology specialist Varian Medical Systems, and Swedish radiotherapy company Elekta competed across the world, and their machines were all considered “pretty good options” for healthcare providers, according to Vano.

This dynamic changed in 2005, however, when Elekta purchased IMPAC — the California-based firm that supplied software used in many LINAC machines at the time.

This propelled Elekta forward and left Siemens “out in the cold”, while also allowing Varian to grow, and ultimately strengthen its position — particularly in the Americas.

Vano, who has been president at ROS for nearly 20 years, and has observed this gradual shift in the market from start to finish, believes it has made the industry less of a “level playing field” over time.

“I’ve been in this business a while now, and I think we’re in a situation today where there’s a lot less competition than there was in the past,” he adds.

“In the last five, 10, even 15 years, we’ve seen a very stable, predictable market for refurbished equipment in general.

“We haven’t seen tremendous growth, but we haven’t seen a decline either — and some years are better than others.”

Refurbished linear accelerators

Today, Elekta and Varian are still two of the dominant players in this space, and supply many of the standard linear accelerators used to give cancer patients day-to-day treatment.

While many other firms offer a range of different technologies in the field, these “workhorse machines” are essential for any healthcare provider looking to open up a radiation oncology centre, says Vano.

Refurbished LINAC machines are often a suitable choice for centres located in rural or suburban areas because they’re unlikely to receive enough patients and, ultimately, make enough money, to justify spending between one and two million dollars on a brand-new machine.

Vano says ROS sells pre-owned LINAC machines — the majority of which are between eight and 10 years old — to its clients for anywhere between 30% and 70% of their original price depending on their age, and how much they’ve been used.

This cost-saving can lower the risk for those clients who aren’t even sure whether setting up a radiation centre is going to be practical, or affordable, in the long run. By purchasing a cheaper, used machine, however, they can at least get off the ground in a more financially viable way.

“We’ve seen many cases where used equipment is installed, the centre gets up and running, and as soon as they’re successful and have a good flow of patients, they can buy brand new equipment and expand that way,” says Vano.

Without refurbished linear accelerators, many patients based in remote locations would have to travel for an hour or longer to the nearest main hospital — which are often the only healthcare facilities able to afford new equipment.

This would present an even greater obstacle for elderly patients, or those who are seriously ill and undergoing particularly intense, or regular, treatment programmes.

But, as Vano says, refurbished equipment allows smaller satellite centres to provide these patients with radiotherapy treatment that would otherwise be too expensive.

“Proximity has a big role to play in the treatment of patients, and that’s one of the reasons we think refurbished equipment makes a lot of sense,” he adds.

The ever-growing importance of LINAC software

When a hospital or clinic no longer has any need for a LINAC machine, the ROS team goes in, removes it, transports it, and then reinstalls it in its new home — wherever that may be. Vano says the company carries out between 10 and 12 of these projects each year.

This whole refurbishment process can take anywhere between three and six weeks to complete, and any software updates or changes that are necessary to keep the machine optimised are made during the reinstallation stage.

Software has not always been such an integral part of these machines’ radiotherapy capabilities, however.

As Vano describes, only last year, ROS removed a linear accelerator in Latin America that had been treating patients since the late-1970s, and featured almost no software at all.

But, due to technical advancements in the field, that machine is closer to being a “museum piece” than a medical device now, and more up-to-date models rely heavily on specialised software to function effectively.

It plays a key role in everything from exactly how much radiation is administered, to storing patient data and cyber security measures.

Advanced software is also critical in more recent technological developments in LINAC machines — including volumetric modulated arc therapy (VMAT), which enables radiotherapy treatment to take place in record time, and hypofractionation, which divides the radiation into larger doses so treatment can take place over a shorter period compared to standard radiotherapy.

And, by teaming up with the “genius software engineers” at Dignatel, Vano believes ROS can now provide a more comprehensive machine, and a more complete service, than ever before.

“When a customer orders a used linear accelerator, they want to know they won’t be faced with expensive upgrades and updates in the future just to keep it functional, and secure,” he adds.

“Partnering with Dignatel allows us to offer full protection, and say ‘here’s your machine, here’s your software — there’s nothing you have to worry about’.

“They have the compliance, the security and the dependability of a new system at a fraction of the cost — so, we’re really excited about that.”

Impact of Covid-19

The ongoing coronavirus pandemic has already had a significant effect on the radiotherapy sector.

In the US, for example, Vano says some clinics have seen a 40% decrease in patient volume, and radiotherapy procedures are one of many types of elective, non-urgent treatments regularly being postponed due to Covid-19.

A national survey conducted in April by the American Society for Radiation Oncology (ASTRO) also found that, while many of the 222 physician leaders surveyed had continued to provide radiation therapy services during the early weeks of the pandemic, 85% reported declines in the number of patients seen, with patient volume down by one-third on average.

“The damage that Covid-19 hasn’t done, cancer has, because patients are more terrified of going in and getting the virus than they are of maybe risking their tumours growing,” says Vano.

The fact many patients, especially elderly ones, have chosen to stay at home and not continue their treatment has also lessened the need for certain pieces of equipment – including LINAC machines — and decreased the money coming into hospitals.

Healthcare centres are having to cut costs to stay afloat, and even, in some cases, move money and resources from departments that are not seeing as many patients to those that are.

“That’s a very clear and visible financial impact on the radiology oncology sector in the US, and it could continue,” adds Vano.

“There’s definitely less cash flow and I think the industry is going to feel it for the next couple of years at least. It’ll take a while to recover.”

And, despite one of the great advantages of refurbished medical equipment being its cost savings, under ordinary circumstances, Vano believes that if his company’s experience during the 2008 global financial crisis is anything to go by, ROS is unlikely to benefit from the current situation.

“In 2008 and 2009, when similar things were happening, we thought it was a good opportunity for used equipment to jump in and help fill those gaps,” he says.

“But that really didn’t happen, because what we’re learned is that most healthcare systems and clinics focus on their core, main hospitals first, and the budgets that do remain go to those larger hospitals rather than the satellite centres and smaller clinics where used equipment may play a role.

“So, we didn’t actually see a spike — when the pie shrinks, everything shrinks with it.”

Vano also describes how, this year — due to the Covid-19 crisis — the number of requests ROS received for pre-owned equipment began to decrease in mid-March.

And although this started picking back up in May, and, as of early-June, inquiries have returned to pre-pandemic levels, the number of projects being carried out by the company is still lower than before the outbreak.

The ‘insatiable demand’ in developing countries

ROS may get a lot of its used linear accelerators from more high-end hospitals in the US and Canada, but the range of countries it sells these machines back to is far greater.

As well as rural or suburban areas in North America, the company has undertaken projects in locations across Latin America, including Mexico, Chile, Bolivia, Peru and Argentina.

Vano also cites one installation in Venezuela that the ROS team thought would be “almost impossible” to carry out in a country that is “desperately in need” of more radiology oncology services.

“There is an insatiable demand for refurbished equipment in the developing world,” says Vano.

Despite this, regulatory barriers within medical equipment markets in several countries have prevented ROS from providing used equipment to some of the places that need it most.

“Certain markets have certain requirements, and there’s often really no rhyme or reason for any of these requirements,” says Vano.

“Probably 50% of our inquiries come from India, and there are a number of physicians and radiology oncologists in India that ask us for pre-owned equipment.

“But, again, the problem there is regulatory. There is a state agency that simply does not allow the importation of used equipment — or, they allow it, but the requirements they impose aren’t realistic.”

Vano also highlights a study by ROS several years ago that found there was roughly one linear accelerator for every 70,000 people in the US compared to one machine for every three-to-four million people in India, adding that there is a “huge, huge need” there.

Another case he brings up is Brazil, which used to be one of ROS’ biggest markets until its government changed the law to impose heavier restrictions on all imports, including medical equipment.

Vano estimates that, while the percentage of LINAC machines out there right now that are refurbished is probably no higher than 5%, this number could increase if some of the regulatory hurdles in countries including India, Brazil and China are broken.

“I think there’s a correlation between places with a free market, and the quality of their healthcare systems, versus the more restricted markets and the quality of their healthcare systems,” he adds.

“Refurbished equipment allows for a lot of growth, and allows for taking greater risks in opening up new centres, and that ultimately benefits the patient.

“But, when you have more restrictive policies, the patient ultimately suffers, and we’ve seen that time and time again in a lot of different countries.”

Between obstructive regulations and the ongoing pandemic, there is certainly no shortage of challenges facing companies such as ROS working in this sub-sector.

However, collaborations like the recently announced partnership with Dignatel are likely to help the firm weather these storms, and Vano’s general outlook remains positive.

“We’re still small and nimble enough — and it’s a huge industry — so there’s still enough supply for us to go after to service the needs of our customers in developing markets,” he adds.

“You still need re-purposed, used machines because there are places in the world where it will never make sense to spend a whole lot of money on putting in a brand new device. You have these pockets where you still need refurbished equipment.”