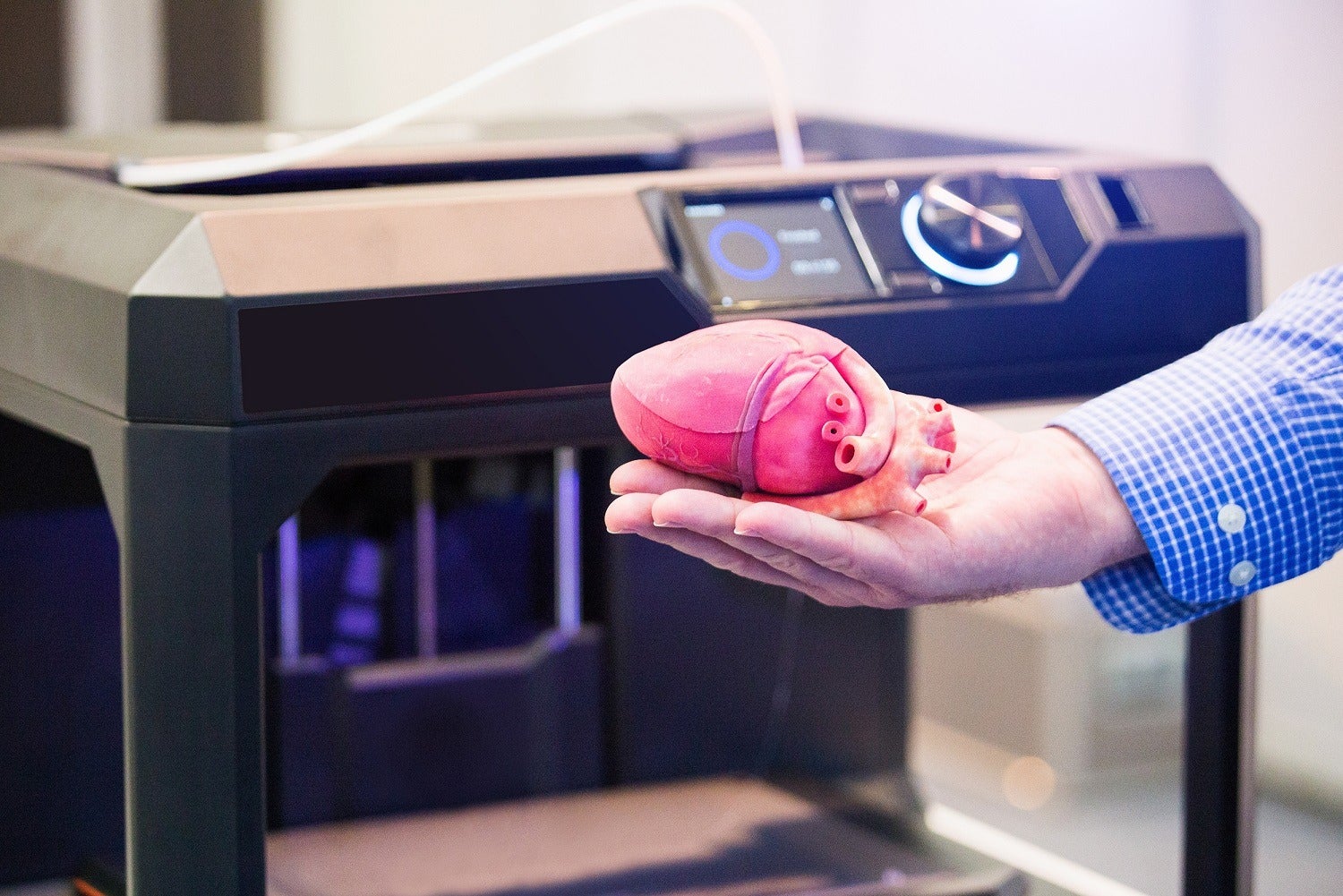

The ever-expanding production method that is additive manufacturing – more commonly referred to as 3D printing – has been harnessed by companies to enhance medical device prototyping, surgical planning and many other applications within the healthcare sector.

This has resulted in rising demands and significant growth, with Research and Markets anticipating that the market for medical device additive manufacturing will grow at an estimated CAGR (compound annual growth rate) of 16.2% over the next few years, and reach a total value of $4.4bn by 2027.

In a report released in late-2020, the Ireland-based market research firm also highlighted some of the more noteworthy companies currently operating in this sector – including both manufacturing heavyweights and rapidly-growing start-ups.

We take a closer look at who these medical device additive manufacturing companies are, and the innovative work they do in this space.

Major companies in the medical device additive manufacturing market

3D Systems

US additive manufacturing firm 3D Systems is currently one of the world’s leading providers of 3D printing for the healthcare industry.

The South Carolina-based company’s printing devices, materials and engineering software are used in several different areas, including plastics, metals and metal casting, jewellery, and dentistry.

Within healthcare, 3D Systems primarily makes 3D-printed implants and orthopaedics, surgical instruments, and orthodontics, as well as providing anatomic models and virtual surgery planning solutions.

Chuck Hull – the company’s co-founder, executive vice president and chief technology officer – is widely credited with inventing 3D printing, having created the world’s first commercial rapid prototyping technology in the mid-1980s.

3D Systems currently has a market cap just shy of $5.6bn, reported total revenues of $629m in 2019 and employs about 2,500 people globally.

Allevi

While many companies on this list spread themselves across a range of sectors and have numerous areas of expertise, American firm Allevi specialises in 3D bioprinters and biomaterials used predominantly in the life sciences field.

The Pennsylvania-based company claims hundreds of global labs use its bioprinting solutions in 3D tissue engineering, organ-on-a-chip research, drug testing, biomaterial development, and regenerative medicine.

Alongside its bioprinting software, bioinks, additives, cells, reagents, and consumables, Allevi makes several versatile, powerful and easy-to-use bioprinters – and says its Allevi 2 device was the world’s first desktop 3D bioprinter.

The company was founded in 2014 and has raised a total of at least $3.6m in funding to date.

EOS

German industrial 3D printing firm EOS has more than 30 years of experience in the additive manufacturing sector, and its technologies are used in aviation, aerospace, automotive, consumer goods, production and healthcare.

Under the umbrella of medical technology, EOS’ customers have made nasal swabs for Covid-19 testing kits, orthopaedic implants, dental prosthetics, biocompatible materials and surgical components using the Bavaria-based company’s solutions.

It is also working to make the production of laboratory equipment and equipment used in medical imaging systems faster, more cost-effective, and more flexible, using additive manufacturing.

EOS and its partners can be found in 35 different countries, and the company claims to have about 1,200 global employees and has installed more than 3,000 of its 3D printing systems across the world.

GE Additive

GE Additive – a subsidiary of US manufacturing giant GE (General Electric) – was founded in 2016, and is based in Munich, Germany.

Its 3D printing work straddles several areas, from aerospace, military and defence, and industrial manufacturing, to automotive, dental and medical.

GE Additive also claims to be the only company that offers two different types of metal additive technologies – electron beam melting (EBM) and direct metal laser melting (DMLM) – and offers a range of certified, high-performing powder materials.

Its main offerings within the medical sector are customised metal orthopaedics, including spinal, cranio-maxillofacial and joint implants.

GE Additive’s multinational parent company boasts a market cap in excess of $100bn, employs 184,000 people globally and generated revenues of $79.6bn in 2020.

Materialise

Belgian 3D printing firm Materialise provides additive manufacturing services and software solutions for the healthcare, automotive, aerospace, consumer goods, and art and design industries.

Its applications in the medical space range from software used by researchers and surgeons, personalised surgical guides, and other point-of-care tools, to customisable orthopaedics – including shoulder, acetabular hip and cranio-maxillofacial implants.

Having been founded in 1990, the Leuven-based company now has a market cap of about $3.4bn, employs more than 2,100 people across the globe and reported a total revenue of €197m ($238m) in 2019.

Stratasys

Minnesota-based additive manufacturing specialist Stratasys produces numerous different types of 3D printer, including FDM (fused deposition modelling), SLA (stereolithography) and PolyJet machines, as well as several related softwares and materials.

These technologies have been used across a wide range of industries – and by some of the most recognisable names in the manufacturing space, such as Google, Ford, Airbus, Siemens and Lockheed Martin.

When it comes to medical applications, Stratasys’ 3D printing capabilities are mainly deployed in surgical planning models, educating and training healthcare professionals, medical device prototyping and dental solutions.

The company currently has a market cap of more than $2.3bn, generated revenues of $636m in 2019 and employs more than 2,000 people across Europe, the Americas and the Asia-Pacific region.