Global investment firm KKR has agreed to acquire Indian medical devices producer Healthium Medtech from UK-based private equity advisory company Apax Partners.

Healthium develops products for use in surgical, post-surgical, and chronic care.

KKR-managed funds will execute the acquisition through a special-purpose vehicle to gain a controlling stake in the Healthium group, including Healthium Medtech.

The financial details were not disclosed. However, Reuters reported that the deal is valued at INR70bn ($838.60m).

The acquisition represents KKR’s most recent investment into the Indian healthcare sector. The company already has invested in J B Chemicals and Pharmaceuticals, Max Healthcare, and Gland Pharma.

KKR Private Equity India head and partner Akshay Tanna said: “Under the leadership of Anish and his talented management team, Healthium has established itself as a leading homegrown producer of medical devices with a strong track record of delivering quality products and a wide distribution network both in India and globally.”

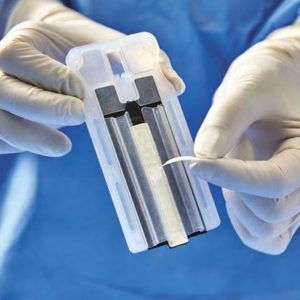

Established in 1992, Healthium specialises in the development, manufacturing, and global distribution of a diverse array of surgical products.

The company caters to the varied requirements of surgeons worldwide, offering solutions in wound closure, arthroscopy, and advanced wound care.

In 2018, Healthium was acquired by the Apax Funds to transform into a global entity in the medical device domain.

During this period, the medical device company enhanced its portfolio of wound closure devices and consumables.

The firm also entered new domains like arthroscopy and advanced wound care through a combination of in-house research and development initiatives and strategic mergers and acquisitions.

As a result, Healthium expanded its footprint from operating in 50 countries to a presence in over 90 nations today.

Healthium CEO Anish Bafna said: “Our products are now used in one in five surgeries globally and we have nearly doubled the markets we’re present in.

“On behalf of the whole management team, I would like to thank the Apax team for their expertise, hard work, and dedication.”

The completion of the transaction is expected in Q3 2024, subject to certain regulatory approvals.

Jefferies served as the financial advisor and Kirkland & Ellis as the legal advisor for Apax Partners and Healthium.

Meanwhile, Moelis & Company provided financial advisory services to KKR, with legal counsel from Simpson Thacher & Bartlett and AZB & Partners.