Neovasc has entered into a collaboration and licensing agreement relating to certain know-how developed by Penn Medicine and the Gorman Cardiovascular Research Group at the University of Pennsylvania.

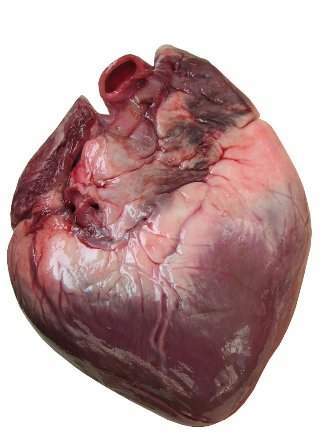

Image: Tiara is Neovasc's minimally invasive transcatheter device for patients who experience severe mitral regurgitation. Photo: courtesy of judith hakze / FreeImages.

This Agreement resolves certain potential claims against the Company that were described in the Company’s Annual Report on Form 20-F and management’s discussion and analysis for Q1. This agreement does not impact either Penn or Neovasc’s patent rights.

Tiara (“Tiara”) is Neovasc’s minimally invasive transcatheter device for patients who experience severe mitral regurgitation (“MR”). There are millions of patients worldwide who suffer from severe MR, a significant percentage of whom are not good candidates for conventional surgical repair or replacement.

Tiara is implanted in the heart using a minimally invasive, transapical transcatheter approach without the need for open-heart surgery or use of a cardiac bypass machine.

This collaboration and licensing agreement contemplates a period of collaboration over the next four years with fees being paid by Neovasc to Penn. Following the first commercial sale of the Tiara, Neovasc will pay a stepped royalty on Tiara revenues. These royalty obligations continue after the four-year collaboration period has ended.

Also contained in the collaboration and licensing agreement are buy-out clauses that allow Neovasc, or an acquirer of Neovasc or the Tiara assets, to buy-out these royalty obligations. For further details, please see the Material Change Report filed by the Company on SEDAR and furnished to the SEC on EDGAR under Form 6-K.

Neovasc CEO Fred Colen said: “This agreement helps to safeguard our efforts to further develop and commercialize the Tiara. We are pleased to have resolved this matter in a manner that allows Neovasc to advance the Tiara program development in the near term, while providing an option to either Neovasc or an acquirer of Neovasc to buy-out these future royalty obligations.”

Source: Company Press Release